Case Study

Hudson Valley Entrepreneurship EcosystemIntro

Illuminating and strengthening a seven-county regional entrepreneurship ecosystem to accelerate innovation, economic diversity, and long-term regional vitality.

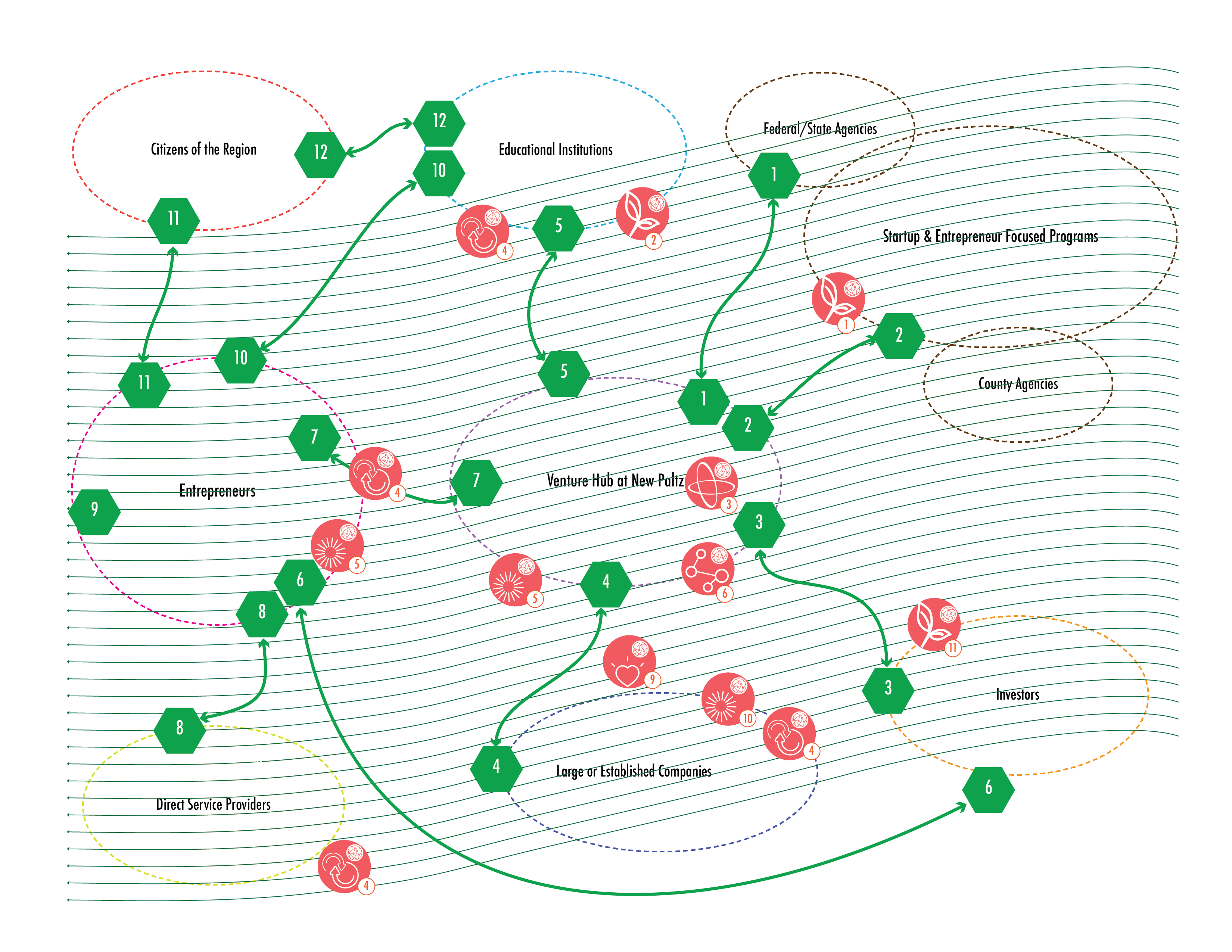

In partnership with SUNY New Paltz and the Hudson Valley Venture Hub, we mapped and activated the Hudson Valley Entrepreneurship Ecosystem to make invisible value exchanges visible, strengthen coordination, and catalyze virtuous cycles of capital, talent, and innovation across the region.

Download the full case study here

This case study is from The Ecosystem Project.

Details

Hudson Valley Venture Hub Ecosystem Illumination

HIghlights

Purpose

To enhance the regional economic environment by directing resources toward growing the entrepreneurship and innovation economy across seven counties in the Hudson Valley—resulting in greater diversity of economic activity, broader participation, and shared regional benefit.

At its heart, the ecosystem exists to create conditions where entrepreneurs can access capital, mentorship, networks, and institutional support in ways that reinforce long-term economic resilience rather than fragmented, one-off successes.

Key Inhabitants

The ecosystem includes a diverse set of interconnected actors:

-

Entrepreneurs – startups, small businesses in formation and growth, mature companies, and individual service providers taking on financial risk to build new ventures.

-

Hudson Valley Venture Hub (Key Orchestrator) – housed within SUNY New Paltz’s School of Business; operates a dual model of direct accelerator services and ecosystem coordination across ~100 regional support organizations.

-

Investors – angel investors, venture capital, banks, sponsors, philanthropists, and foundations serving as the financial engine of the region.

-

Educational Institutions – SUNY New Paltz and regional institutions providing talent pipelines, faculty expertise, tech transfer, and research.

-

Federal, State, and County Agencies – including Empire State Development’s Innovation Hot Spot program, providing funding and economic development infrastructure.

-

Established Companies & Service Providers – large employers, corporate partners, consultants, legal and financial service firms contributing expertise, deal flow, and credibility.

-

Citizens of the Region – future entrepreneurs, job seekers, consumers, and community members who animate the economic fabric.

Landscape Forces

The ecosystem landscape revealed several defining forces:

-

Capital Flow as a Prevailing Wind

Investors, sponsors, and government agencies generate the primary financial current, with startups as key receivers. This flow shapes participation, opportunity, and momentum -

Fragmentation at Entry

Entrepreneurs initially experience the ecosystem as diffuse and difficult to navigate—lacking networks, deal flow, hiring pathways, and clarity of available resources. -

Proximity to New York City

The region sits near one of the world’s largest economies. This creates both gravitational pull (competition for talent and capital) and opportunity (access to markets, partnerships, and interchanges). -

Reliance on External Funding

The Venture Hub and many support organizations depend on state programs and external funding streams, shaping both incentives and sustainability. -

Emerging Virtuous Cycles

As entrepreneurs mature, they return value through job creation, tax revenue, mentorship, and reinvestment—creating reinforcing loops across generations.

Value Dynamics

The ecosystem holds together through layered value exchanges. Key dynamics include:

-

Entrepreneurs ⇄ Investors

Capital, mentorship, deal flow, credibility, and ROI. -

Entrepreneurs ⇄ Venture Hub

Services, acceleration, community, introductions, targeted programming, and knowledge. -

Entrepreneurs ⇄ Service Providers

Revenue, expertise, operational support, and shared growth. -

Educational Institutions ⇄ Ecosystem

Talent pipelines, research, internships, tech transfer, and innovation capacity. -

Established Companies ⇄ Startups

Pilot opportunities, partnerships, leading-edge ideas, and access to new markets.

The Venture Hub acts as a knowledge steward and connector, directing and targeting resources, strengthening network density, and converting fragmented interactions into coherent value flows.

Outcomes

Ecosystem Shifts & Interventions

The work identified targeted interventions across three horizons to increase ecosystem coherence and performance.

Near-Term Shifts

-

Steward Knowledge Networks: Develop baseline data, ecosystem metrics, and mapping to make the invisible visible.

-

Create and Leverage Platforms: Improve matching between entrepreneurs, services, and capital.

-

Increase Storytelling & Visibility: Position the region as an attractive entrepreneurial environment.

Short-Term Actions

-

Cultivate Connections with NYC: Strengthen interchanges and cross-regional density.

-

Engage Regional Education Partners: Increase applied research, tech commercialization, and talent alignment.

-

Create Synergies Among Investors: Improve coordination and amplify capital flows.

Longer-Range Intentions

-

Increase Access to Capital to ignite virtuous cycles of money, mentorship, and talent.

-

Grow Venture Competition Programs to surface and accelerate high-potential startups.

-

Better Connect Service Providers to strengthen collaboration and network effect.

-

Attract and Retain Diverse Talent to expand industry breadth and innovation capacity.

-

Increase Diversity of Entrepreneurs to introduce “positive turbulence,” spark new combinations, and meet the innovation needs of established companies.

Across all interventions, the intention was not to centrally control the ecosystem but to introduce mindful insertions of positive turbulence—strengthening value exchanges and nudging the system toward a higher-functioning state aligned with its purpose.